INTRIGUED IN ATTAINING SUCCESS IN THE PROPERTY INDUSTRY? DISCOVER JUST HOW REALIZING MARKET FADS CAN HELP YOU MAKE PROFITABLE INVESTMENT CHOICES

Material Author-Berg Friedrichsen

Recognizing market patterns is crucial for your realty success. It helps you make clever investment options. By watching on patterns, you can find possibilities and dangers. Stabilizing supply and need discloses when to spend for greater returns. Remain educated, adjust to change, and focus on metropolitan changes and technology developments. Target emerging communities and particular demographics for potential gains. Understanding visit the next page is your secret to effective realty investments.

Value of Market Patterns

Recognizing market fads is vital for successful realty financial investment choices. By watching on market fads, you can acquire useful understandings right into the current state of the realty market. This information permits you to make enlightened choices concerning when and where to invest in properties. Market fads can aid you identify emerging possibilities and prospective dangers, providing you a competitive edge in the real estate industry.

Additionally, recognizing market fads allows you to expect changes in residential or commercial property worths and rental rates. This foresight allows you to readjust your financial investment methods accordingly, maximizing your returns and decreasing dangers. By staying educated regarding market trends, you can place yourself as a smart capitalist that has the ability to adapt to the ever-changing property landscape.

Studying Supply and Need

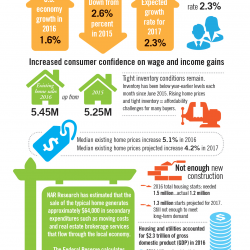

To make enlightened realty financial investment choices, examining supply and need is essential. Comprehending the balance between supply and need in a specific market supplies beneficial understandings right into potential financial investment chances. When the need for residential or commercial properties exceeds the offered supply, it typically causes increased residential or commercial property values and possibly higher returns on investment. On the other hand, an excess of residential or commercial properties relative to require can lead to reduced residential property worths and reduced profitability.

Analyzing supply involves considering the number of buildings available up for sale or lease in a given market. Elements such as brand-new building, population growth, and financial patterns can affect the supply of residential or commercial properties. https://www.primepublishers.com/bam-capitals-investors-give-honest-review-of-their-experience-with-the-accredited-investor-platform-westgate/article_044014d4-f0e9-5efb-b45e-f68809e9e30d.html , on the other hand, is affected by aspects like task chances, populace demographics, and interest rates. By thoroughly researching both supply and demand characteristics, capitalists can identify arising patterns and make tactical investment decisions to make the most of returns.

Keep a close eye on modifications in supply and demand signs, as they can signal shifts in market problems that may affect the success of your property financial investments. Keep in mind, a comprehensive evaluation of supply and need is essential for effective property financial investment techniques.

Making The Most Of Returns Through Trends

Maximize your property investment returns by leveraging present market patterns. To make the most out of your investments, it’s crucial to remain informed and adapt to the ever-changing realty landscape. Maintain a close eye on patterns such as metropolitan movement patterns, technical innovations, and sustainability methods. By straightening your investments with these trends, you can make sure that your residential or commercial properties continue to be attractive and sought-after.

One method to make best use of returns through patterns is by concentrating on arising communities. These areas typically provide reduced residential property rates yet have the possibility for substantial recognition as they come to be much more prominent. Furthermore, take into consideration buying properties that cater to the expanding remote job trend by offering services like home offices or high-speed internet.

Furthermore, staying educated regarding demographic shifts can help you target the appropriate market sectors. For example, buying properties customized to the requirements of aging populaces or young experts can bring about greater tenancy prices and enhanced rental returns. By purposefully straightening your financial investments with existing trends, you can place on your own for lasting success in the property market.

Conclusion

By comprehending market trends, you can make informed choices, make the most of revenues, and decrease dangers in property investment. Evaluating supply and need, and staying ahead of market changes are crucial for success.

Remember, fads are your key to unlocking the full potential of your financial investments. Stay aggressive, remain informed, and stay rewarding.